低佣金吸引投资者注意力

In the fiercely competitive securities industry, brokerage firms are constantly striving to attract new investors. One effective way they achieve this is by offering low commission rates. The commission charged by a brokerage firm can have a significant impact on an investor\'s overall returns, making it a key factor to consider when choosing a broker. In this article, we will explore the topic of \"the brokerage firms with the lowest commission rates\" and delve into the reasons why low commission rates are so appealing to investors.

二、Reducing costs for investors

降低投资者成本

When investors decide to buy or sell securities, they not only consider the price of the securities themselves but also the additional costs involved, such as brokerage fees. By choosing a brokerage firm with the lowest commission rates, investors can significantly reduce their trading costs. This allows them to maximize their potential returns and achieve their investment goals more efficiently.

三、Competitive landscape among brokerage firms

券商竞争格局

In the highly competitive brokerage industry, firms are constantly vying for market share. One way they differentiate themselves is by offering lower commission rates than their competitors. This creates a win-win situation for both investors and brokerage firms. Investors benefit from lower costs, while brokerage firms attract more clients and generate higher trading volumes, ultimately boosting their revenue.

四、Factors influencing commission rates

影响佣金费率的因素

The commission rates charged by brokerage firms are influenced by various factors. One of the most significant factors is the type of securities being traded. Different securities may involve different levels of risk and complexity, which in turn affect the commission rates. For example, trading stocks may have lower commission rates compared to trading derivatives due to the higher risk and more intricate nature of derivatives.

Another factor that affects commission rates is the trading volume. Generally, brokerage firms offer lower commission rates for higher trading volumes. This is because higher trading volumes generate more revenue for the firms, allowing them to reduce their commission rates while still maintaining profitability.

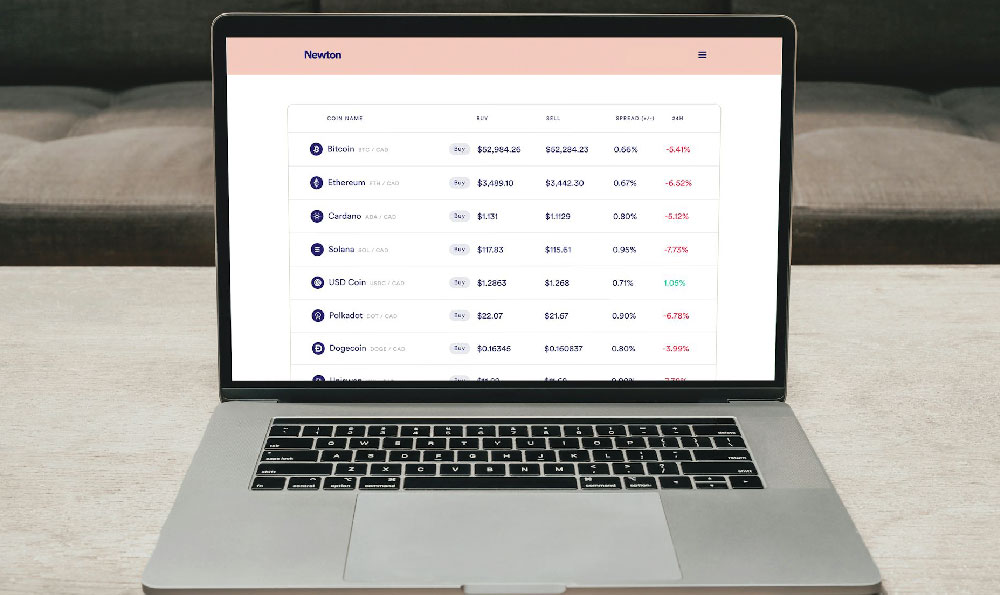

五、The rise of online trading platforms

线上交易平台的兴起

In recent years, the emergence of online trading platforms has revolutionized the brokerage industry. These platforms have significantly lowered the barriers to entry for investors, making it easier and more affordable for them to trade securities. With the rise of online trading platforms, brokerage firms have had to adapt by offering lower commission rates to remain competitive in the market.

六、Conclusion

结论

In conclusion, finding a brokerage firm with the lowest commission rates can greatly benefit investors by reducing their trading costs and increasing their potential returns. The competitive landscape among brokerage firms and the rise of online trading platforms have contributed to the availability of low commission options for investors. By choosing a brokerage firm with low commission rates, investors can make their investments more cost-efficient and ultimately achieve their financial goals more effectively.

开户佣金最低的券商股票

在投资股票时,券商开户佣金是一个很重要的因素。开户佣金越低,对于投资者来说则是成本越低,可以提高投资回报率。本文将介绍一些开户佣金最低的券商股票。

【佣金标准比较】

不同券商的开户佣金标准各有不同。在市场上,一些知名券商如A券商、B券商、C券商等都提供股票交易服务。根据相关数据,A券商的开户佣金最低,B券商和C券商。以开户佣金为一个主要指标进行比较,可以帮助投资者选择合适的券商。

【A券商】

A券商是国内知名券商,不仅有较低的开户佣金,还有良好的服务和撮合能力。其开户佣金为每笔交易的0.2%,最低收费标准是5元。这样的佣金标准对于小额投资者来说非常有吸引力,可以有效降低成本,增加投资收益。

【B券商】

B券商是市场上另一个较为知名的券商,其开户佣金相对较低。B券商的开户佣金为每笔交易的0.25%,最低收费标准是8元。虽然相比A券商略高,但仍然在市场中处于较为低廉的水平。

【C券商】

C券商是另一家提供股票交易服务的知名券商。该券商的开户佣金为每笔交易的0.3%,最低收费标准是10元。相对于A券商和B券商来说,C券商的开户佣金相对较高,但仍然低于一些其他券商。

【其他因素】

开户佣金虽然是选择券商的重要因素之一,但不是唯一的决策因素。投资者在选择券商时还需考虑其他因素,例如交易费用、软件平台、研究报告等。投资者需根据自身需求权衡各方面因素,选择适合自己的券商。

【结语】

开户佣金最低的券商股票是投资者选择券商时需要考虑的一个重要因素。A券商、B券商和C券商都是开户佣金较低的券商,投资者可以根据自身需求,选择适合自己的券商进行股票投资。在选择券商时还需综合考虑其他因素,确保投资决策的全面性和合理性。

开户佣金最低的券商是哪家

**一、券商行业概述**

券商是指证券经营机构,是进行证券交易和提供相关服务的金融机构。它们可以为投资者提供开户、交易、理财等一系列服务。券商之间存在一定的竞争关系,而开户佣金则是投资者在选择券商时非常关注的一个指标。

**二、佣金的定义**

佣金是指券商为投资者提供开户、交易等服务所收取的费用。开户佣金是指投资者在开立券商账户时需要支付的费用,通常是一笔固定的金额或者一定比例的交易金额。投资者在选择券商时,自然希望能找到开户佣金最低的券商。

**三、券商佣金的比较**

券商之间的开户佣金存在差异,因为它们在服务模式、资金实力、投资品种和费用结构等方面存在差异。投资者需要对不同券商的开户佣金进行比较,并选择最适合自己的券商。

以国内几家知名券商为例,比较它们的开户佣金。华通证券的开户佣金为千分之三(即0.3%),光大证券的开户佣金为千分之四,中信证券的开户佣金为千分之五,而招商证券的开户佣金为千分之六。从这些数据可以看出,开户佣金最低的券商是华通证券。

**四、开户佣金的影响因素**

为什么券商的开户佣金存在差异呢?这是由多个因素综合影响的结果。券商的服务模式和费用结构。不同券商可能有不同的服务模式,一些券商采用佣金制度,一些则采用固定费用制度。券商的资金实力和经营策略。一些大型券商可能拥有更多的资金支持,因此可以在一定程度上降低佣金,吸引更多投资者。最后还有券商所处的市场环境。在不同的市场环境下,券商的开户佣金也会有所不同。

**五、寻找佣金最低的券商**

如果投资者希望找到开户佣金最低的券商,除了比较各个券商之间的开户佣金外,还可以考虑以下几个方面。可以考虑券商的其他服务和产品,例如交易费用、理财产品等。可以了解券商的资金实力和市场声誉,选择一个信誉好且具备较强实力的券商。可以咨询其他投资者的经验和建议,了解他们对不同券商的评价。

开户佣金是投资者选择券商时需要考虑的重要因素之一。通过比较不同券商的开户佣金,了解其影响因素,以及考虑其他因素,投资者可以选择到最适合自己的券商。希望本文能够给予读者一些有益的参考和启示。